Early Retirement and Investment

Early Notes

In this post, I gonna talk about the possibility of some strategy that you can try, but it is not assured that the strategy is going to work. This post will changing overtime, along with the journey I going to experience and knowledge I gather. This post is also more specific to people who live in Indonesia. I know too that by talking about this topic, I raise anxiety which leads to stingy attitude and insecurity so please don’t be.

Background

Maybe a bit too early to talk about this and a bit controversial to talk about money, because no one wants to talk about it and almost everybody bad about it, including me too. Unless you have a good fortune, most of us does not financially independent, either we dependent from relatives or work. Financial independence is when your assets sufficient enough to produce income for basic needs and more importantly, freedom.

Financial independence is also mean you can retired at any time. Why retire so early? We do want to have some financial safety net right? so that we would not depend on and not taking advantage of friends, relatives and work, so we can give more to society. Retiring is also mean that you can choose whatever you want and love to do in life, not steered by money.

Strategy

The strategy to achieve financial independence is by creating some large pile of assets that will give you enough cash each year to live with basic needs. That assets is also going to grow over time that greater to inflation.

1. Pile the Assets

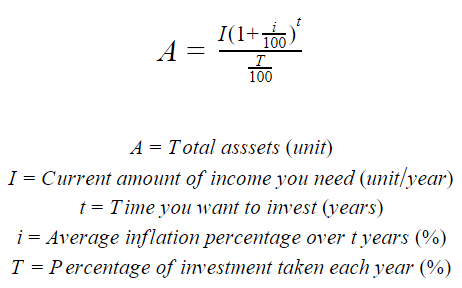

In the time of investment, invest as much as possible with a percentage that will not ruin your own basic needs. To calculate the total of assets you can build to target for, I made up a formula of the calculation:

For example, in Indonesia where the 2017 inflation rate at 3.8% and each year you need 60 million IDR with 4% taken each year, if you set an investment time of 10 years, then this is the total assets you need:

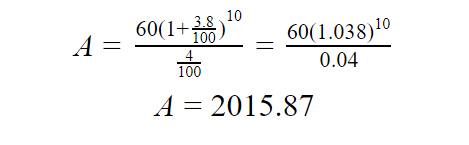

So you need about 2 billion to invest with current rate of inflation. To calculate the inflation adjusted income of investment you will receive after you retired:

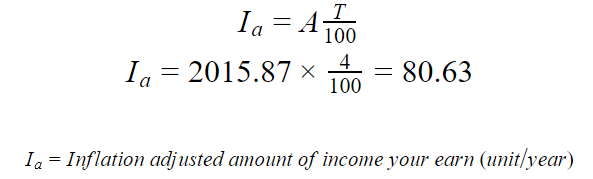

After we achieve that number we can say that ourselves is wealthy and good for retirement. There is also a good diagram of how much money you need to set aside if your want to retired in certain times:

Savings rate versus years to retirement courtesy this post

Savings rate versus years to retirement courtesy this post

With the number in above calculation, it means that you need an investment product that grows with a minimum of the percentage of investment you take every year (4%) plus the inflation percentage (3.8%) that equals 7.8% per year.

When we talk about investment there are broad choices that we can choose (P2P lending, real estate, deposits etc) but consider to choose the one with less hassle, reliable and affordable to start, which I think is mutual funds. A fine mutual fund product usually has above 10% performance over the year. This is some points that I have researched along the way with mutual funds:

- Use mutual funds platform (consider tanamduit, bareksa or SPOR) to easily do a subscription or redemption on your assets.

- Pick only the one licensed to financial services authority (It is called OJK in Indonesia).

- For long-term investment pick stocks or mixed mutual funds. Consider Sucorinvest AM and Sinarmas AM since they have great profit and risk ratio.

- Put your money periodically, for example once in every month or once in every three month. This method is also known as Dollar-cost averaging (DCA) to avoid speculation either the prices are low or high.

- Use mutual fund simulation and investment calculator to predict your future in a given timespan. Consider using this to simulate certain product and use this calculator to calculate investment. There is also another calculator for retirement and college fund.

- After you buy the product, forget it and only rebalance your assets every year (there is a product called Ajaib is coming, it automatically rebalance the assets like Wealthfront in the US).

- Choose sharia products if you believe in the law.

2. Consume Less and Produce More

In the world where we rushing to consume more not giving more, it also creates a hippo trouble in our life. You must know what is a border on essential needs. Our desire usually leads to the quickest solution, not the wisest one. Consider avoiding that doctrine of blinky lifestyle that will burden you and your environment in long-term. If you want some real change, try to ditch social media to avoid the doctrine and start to interact with real people in real life.

Producing more has meaning like instead of using software, for example, try to create one. Instead of listening to music, try to compose one. Instead of hiring a handyman to build a sofa, try to build by yourself. Instead to learn from lectures, try to create your own curriculum. There’s a lot of this world that we can do if we have the effort to do so.

I’ve never been like filthy rich consumer, but I think movies like Scarface, American Psycho, The Family Man and Wall Street will teach you something.

A scene from American Psycho when Christian Bale as Bateman murder his associates just because jealousy over a single business card

A scene from American Psycho when Christian Bale as Bateman murder his associates just because jealousy over a single business card

3. Pick Side Projects

You can create your own project or pick from a contest. By doing a project, not only you will receive money but also you can gain your overall skill and widen your perspective about something you care about. Also same as in point one, I do have some point to note when picking projects:

- Avoid project that takes a long-term maintenance.

- Write and sign MoU (Memorandum of Understanding) before work on the project, even it is from your closest relative.

- In some other time try to pick a project with a different technique (for example if you good in paintings, instead of painting with watercolor, try with oil paints).

- Avoid project that has a relatively small impact (this based on your scale of experience).

- Compare the compensation with the other project that has similar specification.

- Look at your current agenda, is it will bother your primary agenda.

4. Work in Foreign Country

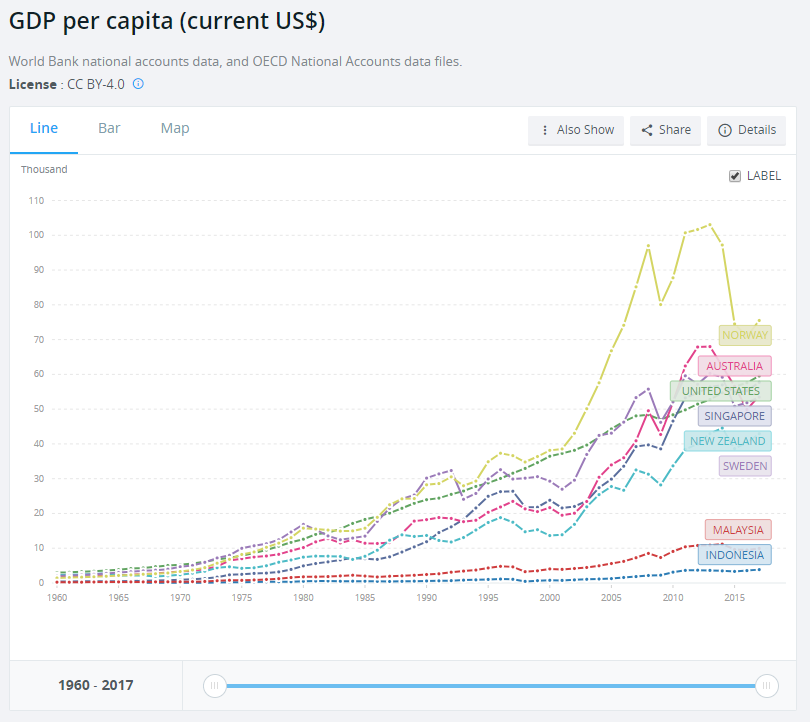

If you good in foreign language, it’s not wrong to start working in foreign country for a while, or the other alternative is taking a remote work. Even in that country has a significant jump in living expenses, usually, the amount of money that you can save is also considerably higher than your current living country. For example in this chart, we can compare the amount of average salary in a country by putting the GDP per capita data:

Gross Domestic Product per capita comparison across countries

Gross Domestic Product per capita comparison across countries

You could also consider watch this talk about Nordic social democracies countries like Norway and Sweden that have several advantages over other countries to build wealth.

5. Build Your Own Company

This is the fastest but also the riskiest way to create wealth, so if you’re young and has an innovative idea that fits with the market, you can try to start a company. By doing this way, don’t forget to manage the share of the equity between your partners and pay yourself if the company turns up to be a good business. There is a good playlist of how to build a startup company here.

Ending Notes

It is you that own yourself and you that give a direction to your own self, this is just the possibilities of ways to create wealth and maintain it through investments. For me, I do have some plan for early retirement, I believe I will get there someday. Even if I too in love to work and want to continue working, I think financial independence is a great assurance for the sake of the next chapter of your life.

This is some other references that I think that great to continue to dig more about this topic.

- Rich Dad Poor Dad by Robert Kiyosaki

- The Simple Path to Wealth by JL Collins

- Principles: Life and Work by Ray Dalio

- Khan Academy Personal Finance

- Khan Academy Finance and Capital Markets

- Prita Ghozie Twitter Feed

- Prita Ghozie Personal Blog

- Mr Money Moustache Talk

- Mr Money Moustache Blog

- Dan Sawatzky Talk